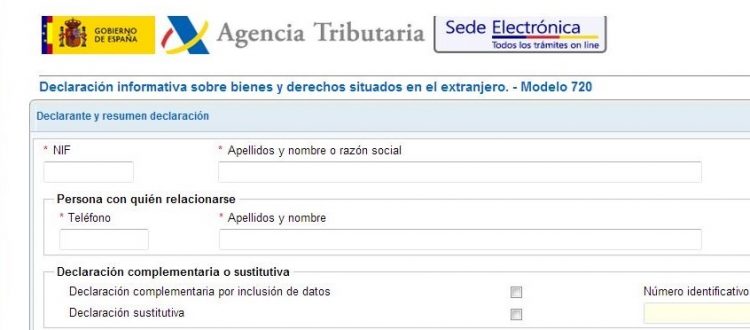

Form 720 – TAX RESIDENCE IN SPAIN

Form to declare the taxes.

All the tax residents in Spain should declare here their assets and goods abroad. To do that, the Tax Authorities created the Form 720.

The Form 720 of the 2017 exercise should be submitted on March 2018 and it is going to be obligatory, inter alia, for the natural and legal persons resident in the Spanish territory and permanent establishments.

It is an official form that only informs about assets and goods abroad, and doesn’t involve the obligation to pay a tax debt. It is made for: inform about values, rights, insurances and incomes placed, managed or obtained abroad; inform about the bank accounts in financial institutions abroad; Inform about properties or rights over properties abroad.

There is not the obligation to submit or inform in the Form 720 about the assets that, summing themselves, don’t overcome 50.000 euros. If a group of assets overcome the 50.000 euros, then, all the goods and assets should be declared.

Sanctions for lack of payment to the Spanish State:

There can be formal sanctions when the submit of the Form 720 is incomplete, inaccurate or with false information. From 5.000 euros for data (with a minimum of 10.000 euros) or 100 for data (with a minimum of 1.500 euros), depending on if there has been a previous requirement of the Government.

Who is a tax resident in Spain and who is required to present the Form 720:

To consider a person as a fiscal resident in Spain, the tax authorities consider the next details:

That the person is an ordinarily resident, in other words, that the person remains in Spain more than 183 days in a calendar year. The stay is an objective issue, regardless of if he/she is a professional, a student or a refugee, or others. It is not important if the person has any intention of settle in Spain, but the fact that remains more than 183 days in a calendar year in Spain, according to the article 9.1 of the Law 35/2006, about the Personal Income Tax.

The Supreme court has understood, creating jurisprudence, that the idea of “sporadic absences” must focus exclusively to the objective fact of the duration or intensity of the stays out of the Spanish territory, asserting that “this legal stay (183 days in a calendar year) isn’t affected for the fact that the taxpayer is absent temporarily or occasionally.